The ICICI Prudential Nifty 50 Index Fund is a compelling option for investors seeking to mirror the performance of India’s leading benchmark, the Nifty 50. This article delves into the intricacies of this fund, shedding light on its structure, benefits, risks, and more, ensuring that you have all the information needed to make an informed investment decision.

# What is the ICICI Prudential Nifty 50 Index Fund?

✔️ The ICICI Prudential Nifty 50 Index Fund is a passive investment vehicle designed to replicate the performance of the Nifty 50 Index. This index comprises the top 50 companies listed on the National Stock Exchange (NSE) of India, representing various sectors of the economy. By investing in this fund, investors gain exposure to a diversified portfolio of blue-chip stocks, which are known for their stability and growth potential.

The primary goal of this index fund is to achieve returns that closely correspond to the total returns of the Nifty 50 Index, subject to tracking errors. The fund employs a full replication strategy, meaning it invests in all the stocks that constitute the Nifty 50 Index in the same proportion as their representation in the index.

# Historical Performance

✔️ Understanding the historical performance of the ICICI Prudential Nifty 50 Index Fund is crucial for prospective investors. Historically, the Nifty 50 Index has delivered robust returns, reflecting the growth trajectory of the Indian economy. Over the past decade, the index has shown resilience, bouncing back from market downturns and consistently outperforming many other investment avenues.

The fund’s performance is directly linked to the Nifty 50 Index, which means that its returns are typically in line with the overall market trends. Investors can expect their investments to grow at a rate similar to the market average, providing a sense of predictability and stability. However, it’s important to note that past performance is not indicative of future results, and investors should consider multiple factors before making investment decisions.

# Investment Strategy

✔️ The investment strategy of the ICICI Prudential Nifty 50 Index Fund revolves around passive management. Unlike actively managed funds where fund managers make individual stock selections, this index fund follows a systematic approach. By investing in the exact constituents of the Nifty 50 Index, the fund aims to minimize human bias and errors, ensuring that its performance closely tracks the index.

The full replication strategy adopted by the fund involves purchasing all the stocks in the Nifty 50 Index in the same weightage. This method ensures that the fund’s returns mirror those of the index, minus the expense ratio and tracking errors. This strategy is ideal for investors who prefer a hands-off approach and seek to benefit from the long-term growth of the Indian equity market.

Click here…Know More

# Benefits of Investing in the Fund

✔️ Investing in the ICICI Prudential Nifty 50 Index Fund offers several benefits:

- Diversification: By investing in a single fund, investors gain exposure to 50 of the largest and most established companies in India, reducing the risk associated with investing in individual stocks.

- Low Cost: Index funds generally have lower expense ratios compared to actively managed funds, making them a cost-effective investment option.

- Simplicity: The fund’s strategy is straightforward and easy to understand, making it accessible to novice investors.

- Market Performance: The fund’s returns are aligned with the performance of the Nifty 50 Index, which has a strong historical track record.

- Reduced Risk of Human Error: Passive management eliminates the risk of poor stock selection by fund managers, as the fund strictly follows the index.

# Risk Factors

✔️ While the ICICI Prudential Nifty 50 Index Fund offers numerous benefits, it is not without risks. Investors should be aware of the following potential risks:

- Market Risk: The fund’s performance is directly tied to the Nifty 50 Index, meaning it is subject to market volatility. Economic downturns, political instability, or adverse global events can impact the index and, consequently, the fund’s returns.

- Tracking Error: Although the fund aims to replicate the index, slight deviations can occur due to various factors, such as changes in the index composition, fund expenses, and liquidity issues.

- Limited Flexibility: As a passive fund, the ICICI Prudential Nifty 50 Index Fund cannot take advantage of short-term market opportunities or defensive strategies during market downturns.

# Comparison with Other Index Funds

✔️ When comparing the ICICI Prudential Nifty 50 Index Fund to other index funds, several factors stand out:

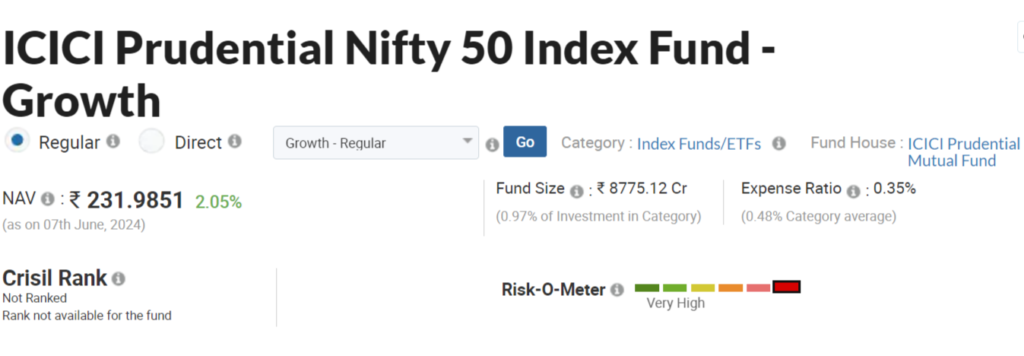

- Expense Ratio: The fund boasts a competitive expense ratio, often lower than many actively managed funds and comparable to other index funds.

- Tracking Accuracy: The fund has demonstrated a high degree of accuracy in tracking the Nifty 50 Index, minimizing tracking errors.

- Performance Consistency: The fund’s performance has been consistent with the market index, providing reliable returns to investors.

Other popular index funds, such as those tracking the BSE Sensex or broader indices like the Nifty 100, may offer different risk-return profiles and sectoral exposures. Investors should consider their investment goals, risk tolerance, and time horizon when choosing between various index funds.

# How to Invest

✔️ Investing in the ICICI Prudential Nifty 50 Index Fund is straightforward. Follow these steps to start your investment journey:

1. Open an Account: If you don’t already have one, open an account with a brokerage firm or directly with ICICI Prudential Mutual Fund.

2. Complete KYC: Ensure your Know Your Customer (KYC) details are updated. This process is mandatory for mutual fund investments in India.

3. Choose Investment Mode: Decide whether you want to invest a lump sum amount or start a Systematic Investment Plan (SIP) for regular contributions.

4. Submit Application: Fill out the investment application form, either online or offline, and submit it along with the required documents.

5. Track Your Investment: Once your investment is processed, you can track the performance of the fund through your brokerage account or the ICICI Prudential Mutual Fund website.

# Expense Ratio

✔️ The expense ratio of a mutual fund is a critical factor for investors. It represents the annual fee charged by the fund to manage investors’ money. The ICICI Prudential Nifty 50 Index Fund has a low expense ratio, typically ranging between 0.1% and 0.3%, making it an attractive option for cost-conscious investors.

A lower expense ratio means that a larger portion of your investment remains invested in the market, potentially enhancing your returns over time. This cost-efficiency is one of the primary advantages of investing in index funds compared to actively managed funds, which often have higher management fees.

# Dividends and Payouts

✔️ The ICICI Prudential Nifty 50 Index Fund distributes dividends to its investors, albeit infrequently. The dividends are a share of the profits earned by the underlying stocks in the index. However, since the primary objective of the fund is capital appreciation rather than income generation, dividend payouts are typically modest.

Investors should note that the dividends received from the fund are subject to taxation, and the fund’s Net Asset Value (NAV) will reduce by the dividend amount on the ex-dividend date.

# Tax Implications

✔️ Understanding the tax implications of investing in the ICICI Prudential Nifty 50 Index Fund is essential for maximizing after-tax returns. The tax treatment of the fund’s gains and dividends can significantly impact your overall investment performance.

- Capital Gains Tax: Gains from the sale of fund units are subject to capital gains tax. If the units are held for more than one year, the gains qualify as long-term capital gains (LTCG) and are taxed at 10% for amounts exceeding INR 1 lakh per financial year. Short-term capital gains (STCG) on units held for less than one year are taxed at 15%.

- Dividend Distribution Tax: Although the dividend distribution tax (DDT) has been abolished, dividends received from the fund are now taxable in the hands of the investor at their applicable income tax slab rate.

# Who Should Invest?

The ICICI Prudential Nifty 50 Index Fund is suitable for a wide range of investors, including:

- Long-term Investors: Those seeking to benefit from the long-term growth potential of the Indian equity market.

- Cost-conscious Investors: Individuals looking for a low-cost investment option with a competitive expense ratio.

- Diversification Seekers: Investors who want to diversify their portfolio with exposure to top Indian companies.

- Passive Investors: Those who prefer a hands-off investment approach and are content with market-average returns.

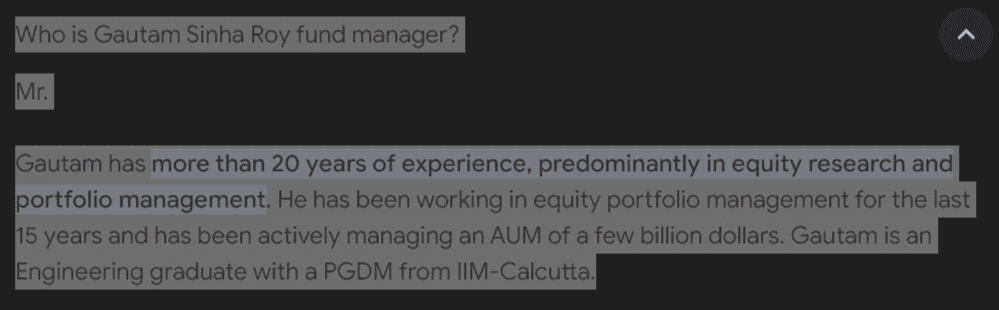

# Fund Management

✔️ The success of the ICICI Prudential Nifty 50 Index Fund can be attributed to its experienced management team. The fund is managed by a team of seasoned professionals who ensure that the fund’s portfolio is accurately aligned with the Nifty 50 Index. Their expertise in portfolio management and adherence to a disciplined investment strategy contribute to the fund’s consistent performance.

The fund managers continually monitor the index composition, rebalance the portfolio as needed, and manage liquidity to minimize tracking errors and maintain cost efficiency.

# Market Outlook

✔️ The future prospects of the ICICI Prudential Nifty 50 Index Fund are closely tied to the outlook of the Indian equity market. The Indian economy is poised for robust growth, driven by favorable demographics, structural reforms, and increasing foreign investments. As the economy expands, the Nifty 50 Index, and consequently the fund, is likely to benefit from the positive market trends.

However, investors should remain cautious of potential market risks, including geopolitical uncertainties, inflationary pressures, and global economic slowdowns, which can impact market performance.

# FAQs about ICICI Prudential Nifty 50 Index Fund

- What is the primary objective of the ICICI Prudential Nifty 50 Index Fund?

✔️ The primary objective is to replicate the performance of the Nifty 50 Index by investing in the same stocks in the same proportions. - How does the expense ratio affect my returns?

✔️ A lower expense ratio means more of your investment remains in the market, potentially enhancing your overall returns over time. - Can I start a SIP in the ICICI Prudential Nifty 50 Index Fund?

✔️ Yes, you can start a Systematic Investment Plan (SIP) to invest regularly in the fund. - What are the tax implications of investing in this fund?

✔️ Gains from the fund are subject to capital gains tax, and dividends are taxed at the investor’s applicable income tax rate. - Is this fund suitable for short-term investments?

✔️ The fund is better suited for long-term investments due to market volatility and the potential for higher returns over an extended period. - How often does the fund distribute dividends?

✔️ Dividends are distributed infrequently and are typically modest, as the fund focuses on capital appreciation.

# Conclusion

The ICICI Prudential Nifty 50 Index Fund offers a straightforward and efficient way to invest in the Indian equity market. With its low-cost structure, diversification benefits, and alignment with the Nifty 50 Index, the fund is an excellent choice for investors seeking stable, long-term growth. While it carries inherent market risks, its passive investment strategy and experienced management team make it a reliable option for both novice and seasoned investors. By understanding the intricacies of the fund, investors can make informed decisions that align with their financial goals and risk tolerance.